Intel’s Q2 Financial Results Show It Lost Half-a-billion

Intel, the largest U.S. chipmaker, stunned shareholders by reporting a Q2 deficit of about $500 million, the first quarterly deficit in decades, and it might require some of the $280 billion CHIPS and Science ACT to help turn things around. Falling demand for PC parts and general economic instability were mentioned by the firm as the primary causes of the decrease.

In general, Intel saw a 22 percent drop in sales over the previous year. Intel has reduced its annual sales forecast from $68 billion to $65 billion as a direct consequence of these findings. Yikes.

Table of contents

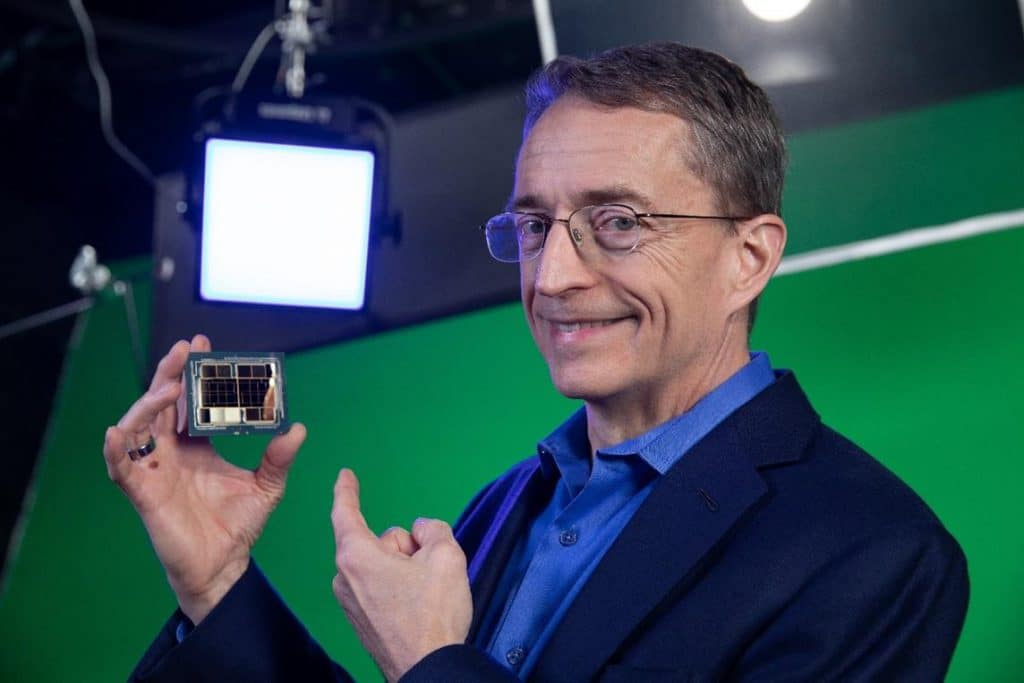

Pat Gelsinger says

Pat Gelsinger, CEO of Intel, called the findings “disappointing.” Gelsinger stated that the firm’s performance this quarter fell short of expectations.

We know we can and will improve. Even while the sharp drop in business growth was the primary factor, our own execution problems are also reflected in the gap. He went on. We are adaptable to the ever-shifting nature of business, maintaining tight relationships with our clientele even as we maintain a steadfast commitment to our strategic goals and future prospects. In order to speed up our change, we are actively seeking out this tough situation.

Senior Financial Director David Zinsner expounded on the decreases in prepared remarks, blaming in part a worse than projected drop due to covid-19. Zinsner attributed the company’s fiscal woes to a confluence of factors, including increased prices, higher inflation, and fallout from the conflict in Ukraine. Our profits for the period were far below projections, and a major change to our full fiscal outlook is needed, Zinsner said, because of the challenging macroeconomic climate and our own execution issues.

Intel has said that it would be passing on some of the cost increases from inflation to customers. If you’re looking to purchase new Intel processors, you may like to do so before the beginning of the fourth quarter, as Zinsner has supposedly affirmed the business is preparing to raise prices for components, as flagged up by PC World. Zinsner didn’t specify a price hike, but earlier reports indicated it could be as much as 20% for some processors.

Investments Are On the Way

Earlier that day, the House of Representatives had agreed to enact a record $280 billion budget measure that would pump $52 billion into the semiconductor sector, so the announcement of Intel’s large Q2 deficits struck as a bit of a surprise. President Joe Biden, in a speech in favor of the measure, said that the investments in local semiconductor manufacturing will help to bring down costs for consumer products in the long run.

As a chip manufacturer that does not outsource its production to other parties like TSMC, Intel stands to profit the most from this legislation as opposed to rival US chipmakers AMD and Nvidia. Gelsinger lost $500 million in a few short months, but he was still hopeful about the future because of the anticipated high demand for semiconductors.