In the world of financial trading, two prominent markets have gained significant attention in recent years: crypto trading and forex trading. While both involve the buying and selling of currencies, they operate on different principles and offer unique opportunities. Understanding the difference between cryptocurrency trading and forex trading is essential for anyone looking to venture into these exciting markets.

In this article, we will explore the three main differences that set crypto trading apart from forex trading, providing you with valuable insights to make informed investment decisions.

Crypto trading vs. Forex trading: How are They different?

Crypto trading vs. Forex trading: Here are three major pointers that separate crypto trading from Forex trading.

1. Market Structure and Volatility

Crypto trading, as the name suggests, involves the buying and selling of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Unlike forex trading, which revolves around national currencies, the cryptocurrency market operates 24/7 and is decentralized. This decentralized nature means that cryptocurrencies are not governed by any central authority, making them less susceptible to government policies or economic indicators.

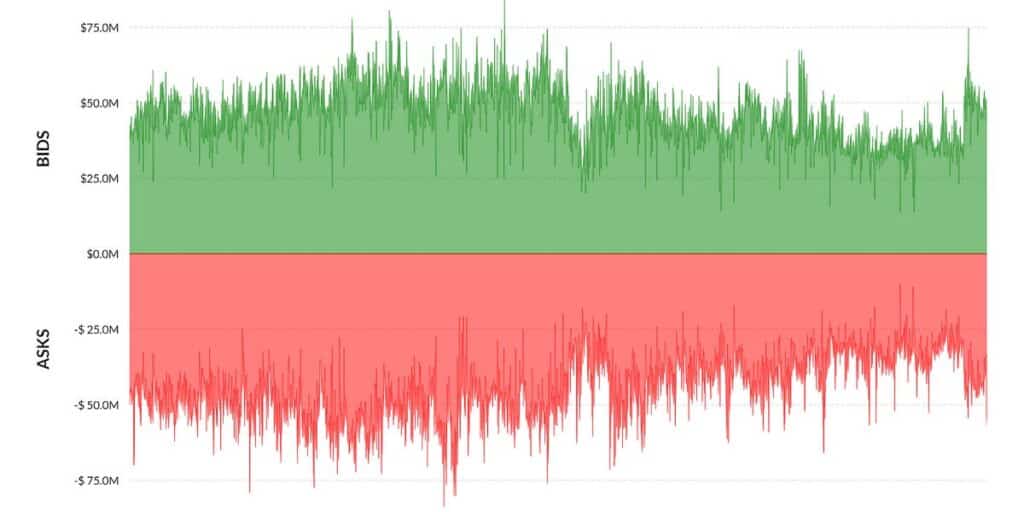

One of the standout differences between crypto trading and forex trading is the volatility of the crypto market. Cryptocurrencies are known for their price fluctuations, which can be extreme and rapid. This volatility presents both opportunities and risks for traders. On the one hand, it allows for potentially high returns in a short period.

On the other hand, it also exposes traders to substantial losses. Traders in the crypto market must carefully analyze market trends, news, and technical indicators to navigate this wild ride effectively.

2. Trading Accessibility and Liquidity

Forex trading, short for foreign exchange trading, involves buying and selling national currencies in the global foreign exchange market. Unlike the crypto market, forex trading operates within a centralized structure, where currencies are traded through regulated exchanges and financial institutions. As the largest financial market globally, forex trading boasts immense liquidity and accessibility.

One of the key differences between crypto trading and forex trading lies in their accessibility. Forex trading is open to a wide range of participants, including individual traders, banks, corporations, and governments. This accessibility contributes to the high liquidity of the forex market, meaning that traders can enter and exit positions swiftly without significantly impacting prices.

In contrast, crypto trading has traditionally been more accessible to individual traders and retail investors. However, as cryptocurrencies gain mainstream adoption, institutional investors are also increasingly entering the market. While the liquidity of the crypto market has improved over the years, it may still face occasional liquidity challenges, especially with less popular or newly launched cryptocurrencies.

3. Regulatory Environment and Fundamental Analysis

Another crucial difference between crypto trading and forex trading lies in the regulatory environment and the approach to fundamental analysis. Forex trading operates within a highly regulated framework, with government oversight and strict compliance requirements. Central banks, economic indicators, and geopolitical events significantly influence forex markets. Traders in the forex market often rely on fundamental analysis to assess the health of economies, make informed decisions, and predict currency movements.

On the other hand, the crypto market operates in a relatively nascent and evolving regulatory landscape. While some countries have implemented regulations to govern cryptocurrency exchanges and transactions, the regulatory frameworks are still developing in many jurisdictions. This regulatory uncertainty adds an additional layer of risk and volatility to crypto trading.

Moreover, fundamental analysis in the crypto market differs from that in the forex market. Crypto traders often focus on factors such as technological developments, partnerships, community sentiment, and market trends to assess the potential of cryptocurrencies.

The Takeaway

So, in a nutshell, the difference between cryptocurrency trading and forex trading can be attributed to market structure and volatility, trading accessibility, and liquidity, as well as the regulatory environment and fundamental analysis. Crypto trading offers a dynamic and volatile market with the potential for substantial returns but also carries higher risks.

Forex trading, on the other hand, provides a more established and regulated market with high liquidity and a broader range of participants. Ultimately, the bout involving Crypto trading vs. Forex trading depends on your risk appetite, investment goals, and personal preferences. Both markets offer unique opportunities and challenges.