We’ve zoomed past the halfway mark of 2023, my fellow tech enthusiasts, and let me tell you, the tech world is spinning faster than ever! If you want to stay in the game, you’ve got to keep a close eye on the latest fintech development trends. And one field that’s constantly evolving and reshaping the world of finance is none other than fintech.

The growth of fintech software development has been nothing short of extraordinary in recent years. In fact, it’s projected to reach a staggering $188 billion by the year 2024. It’s no wonder why—users like you and me are becoming more tech-savvy, craving automation, digitization, and seamless business experiences. And fintech is our knight in shining armor, demolishing the hurdles of traditional finance, digitizing payments, and making finance accessible to all.

Contents

Five Most Rewarding Fintech Development Trends

So, here are five fintech development trends that you absolutely can’t afford to miss.

1. Digital-Only Banks

Why bother stepping foot inside a traditional bank when you can handle all your banking needs right from the comfort of your cozy home? Say hello to the latest trend in the banking world: digital-only banks. These innovative banks have taken the concept of convenience to a whole new level by bringing banking services right to your doorstep, quite literally!

Gone are the days of physical branches with their long queues and limited operating hours. With digital-only banks, everything happens online, offering you lightning-fast transactions, round-the-clock accessibility, and a seamless digital experience. But what sets these banks apart and makes them extra special? Well, it’s their ability to keep fees to a minimum and provide competitive interest rates, all thanks to their nifty cost-cutting strategies.

To make digital-only banking work like a charm, you need a solid digital infrastructure, an app that’s so user-friendly it practically holds your hand, and, of course, widespread Internet availability. While these banks are thriving in developed countries, they’re still a distant dream for many folks in developing and underdeveloped nations.

But hey, who knows what the future holds? Maybe digital-only banks will soon become the norm worldwide, bringing financial convenience to everyone’s fingertips.

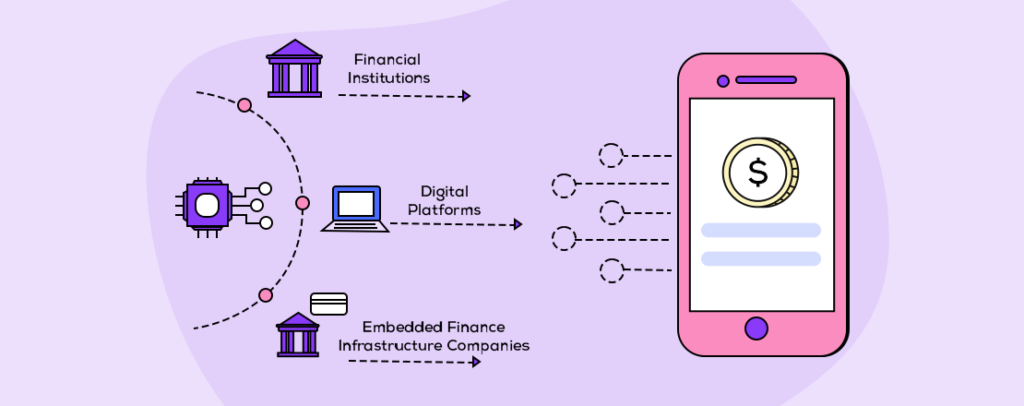

2. Embedded finance

Embedded finance is one of the most exciting and lucrative fintech development trends, folks! So, what’s the deal? Well, it’s all about bringing financial services, like payments, directly into non-financial platforms. Sounds pretty handy, right? With embedded finance, you can say goodbye to the hassle of switching between different apps just to complete a simple transaction.

Picture this: you’re using a fabulous shopping app, filling up your virtual cart with all your favorite goodies. Now comes the moment to make a payment and bam! You’re suddenly whisked away to another app to finish the transaction. Talk about an inconvenient detour!

But fear not; embedded finance is here to save the day! No more app-switching shenanigans. With this clever innovation, you can make instant transactions right within the very same app you’re using. Just think about all those eCommerce apps offering payment options as a prime example of embedded finance at work. It’s like having a financial wizard right at your fingertips, ready to make your shopping experience smoother than ever before.

3. RegTech

When we talk about fintech, one concern that never fails to make an appearance is security. It’s a valid worry, and that’s why regulators play a crucial role in carefully monitoring fintech platforms to ensure user safety and prevent financial crimes. But let’s be honest, regulating the vast array of fintech platforms is no walk in the park. That’s where our hero, Regulation Technology (RegTech), swoops in to save the day!

RegTech, my friends, is all about using technology to streamline and automate those complex regulatory and compliance processes. Think of Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, for example. RegTech is like a trusty sidekick that helps fintech platforms manage these tasks more efficiently.

And that’s not all! The beauty of RegTech lies in its ability to amp up risk management, beef up fraud detection, and supercharge reporting capabilities. There are amazing platforms out there, like ComplyAdvantage, that offer AI-powered compliance solutions. These clever tools work their magic and make fintech platforms a fortress of security for users.

4. Peer-To-Peer Lending

Peer-to-peer lending ranks among the best fintech development trends that are causing quite a stir: According to some fancy market research, the alternative finance market was valued at a whopping $10.82 billion in 2022. And wait for it—the experts predict it’s going to grow at a mind-boggling compound annual growth rate (CAGR) of 20.2% by the year 2030. Now, that’s some serious growth!

But what’s all the fuss about peer-to-peer lending? Well, my friends, this trend is revolutionizing the way we borrow and lend money. It’s all about cutting out those traditional intermediaries, like banks and financial institutions and connecting borrowers directly with lenders through nifty third-party apps.

With peer-to-peer lending, you can kiss those lengthy approval processes and paperwork headaches goodbye. It’s all about convenience, baby! Borrowers now have access to a wider range of financial options, and guess what? They can snag some pretty competitive interest rates while they’re at it.

But it’s not just borrowers who are benefiting from this fintech magic. Oh no, lenders are jumping on the bandwagon too! They now have the opportunity to invest their hard-earned cash and enjoy some sweet high-return opportunities. Talk about a win-win situation for everyone involved!

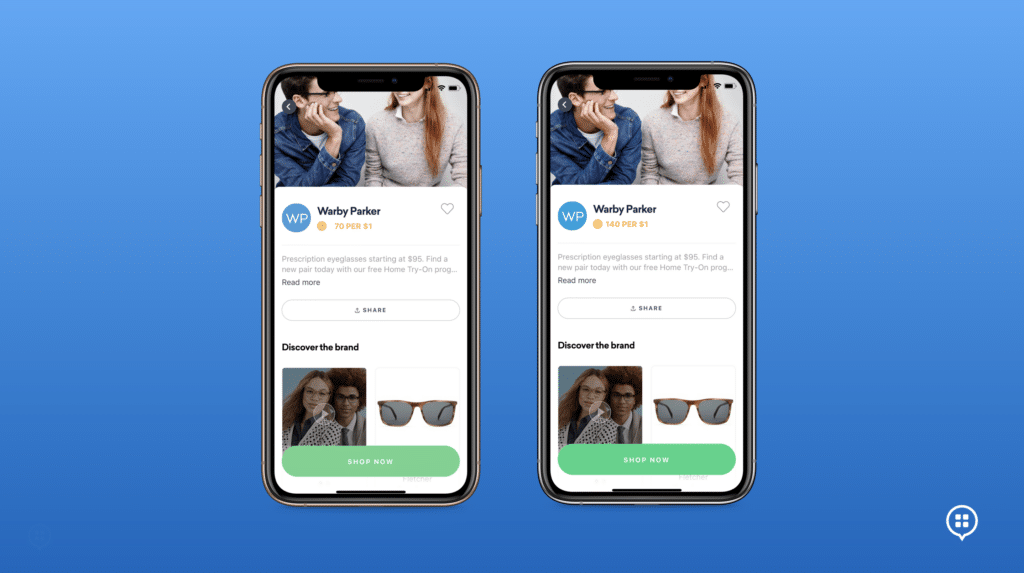

5. Personalisation

Artificial intelligence (AI) is about to revolutionize the fintech world with a touch of personalization! Soon AI, machine learning, and data analytics will come together to analyze mountains of data. Why, you ask? Well, to uncover our choices and preferences when it comes to our financial behavior, of course!

Picture this: a world where your financial experience is tailor-made just for you. Thanks to the power of AI, it’s all about personalization, baby! From personalized dashboards that cater to your unique needs to handy alerts and notifications that keep you in the know, these features are designed to skyrocket engagement and empower you to make informed decisions.

And guess what? This personalization party isn’t just a one-time deal. Oh no! AI has its sights set on the investment space as well. Imagine having a virtual financial advisor who understands your investment goals and guides you toward better outcomes. With personalized insights and recommendations, you’ll feel like a financial superstar, making confident moves in the investment game.