In the realm of finance, tales of deception, greed, and manipulation have left an indelible mark on history. From Ponzi schemes to corporate fraud, the world has witnessed some of the biggest financial scams in recorded history. In this article, we delve into the dark underbelly of the financial world to uncover the stories behind these notorious scams. Brace yourself as we explore the five largest financial scams, unraveling the tactics, impacts, and lessons learned from each.

Contents

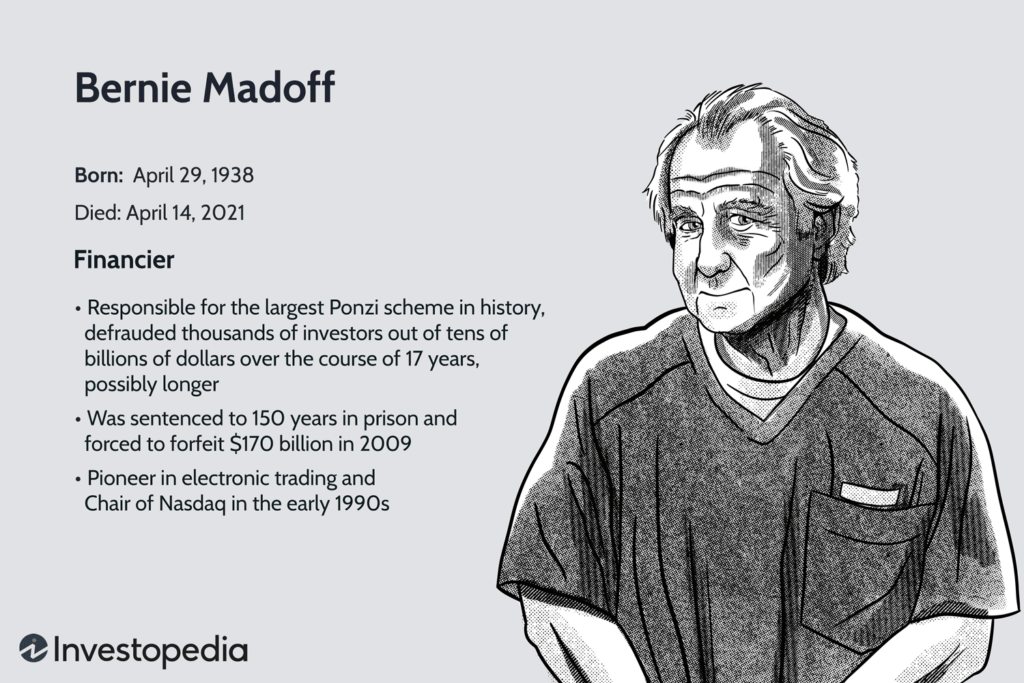

1. The Bernie Madoff Ponzi Scheme

The Bernie Madoff Ponzi scheme stands as one of the most infamous and largest financial scams in history. Operating for several decades before its exposure in 2008, Madoff’s scheme defrauded investors of an estimated $65 billion. Madoff promised consistently high returns, using funds from new investors to pay off older ones, creating an illusion of success.

The impact of the Madoff Ponzi scheme was catastrophic, wiping out life savings, decimating charities, and causing significant financial losses for individuals, hedge funds, and financial institutions. This scandal shed light on the importance of thorough due diligence, independent audits, and regulatory oversight to protect investors from falling prey to similar schemes.

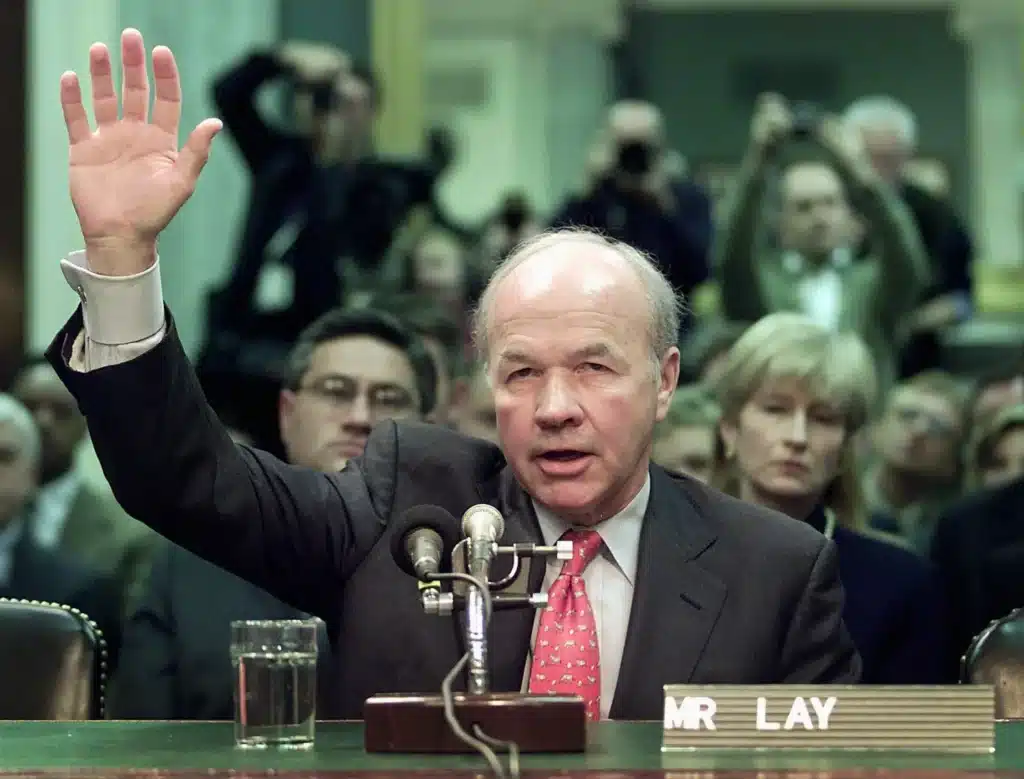

2. Enron Scam

The Enron scandal unraveled in 2001, and revealed a web of deceit, fraudulent accounting practices, and corporate misconduct. Once regarded as one of the world’s leading energy companies, Enron collapsed under the weight of its financial misstatements and deceptive practices.

Enron’s executives used off-balance-sheet entities and creative accounting methods to inflate profits and hide losses. The fallout from the Enron scandal was far-reaching, resulting in the loss of thousands of jobs, a wave of corporate reform, and increased scrutiny of accounting practices. The Enron scandal serves as a stark reminder of the importance of transparency, ethical leadership, and effective corporate governance.

3. Lehman Brothers

The collapse of Lehman Brothers in 2008 marked a pivotal moment in the global financial crisis. As one of the largest investment banks in the United States, Lehman Brothers succumbed to excessive risk-taking, complex financial products, and a deteriorating housing market.

Lehman Brothers’ downfall had a cascading effect on the global financial system, causing panic and triggering a domino effect of bank failures and market turmoil. The repercussions of the financial crisis were severe, resulting in widespread economic recession, job losses, and a loss of confidence in the financial industry. The Lehman Brothers collapse highlighted the dangers of excessive leverage, lax regulation, and the interconnectedness of the global financial system.

4. The Bre-X Minerals Scandal

The Bre-X Minerals scandal, exposed in 1997, involved the fraudulent reporting of massive gold reserves in Indonesia. The company, Bre-X Minerals Ltd., claimed to have discovered a rich gold deposit, triggering a stock frenzy and propelling its market value to astronomical heights.

However, it was later revealed that the gold deposit had been falsified, and the reported reserves were essentially non-existent. The Bre-X Minerals scandal resulted in substantial financial losses for investors, legal battles, and the collapse of the company. This event serves as a cautionary tale about the dangers of blind trust, inadequate due diligence, and the need for independent verification in the investment world.

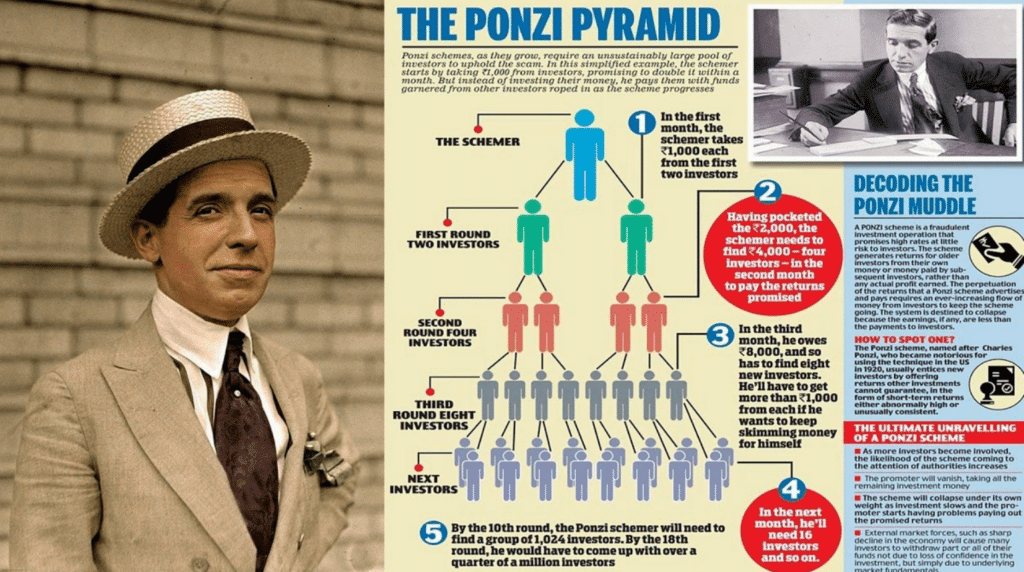

5. The Charles Ponzi Scheme

No discussion of financial scams would be complete without mentioning the infamous Charles Ponzi scheme. Originating in the early 20th century, Ponzi promised investors extraordinary returns on international postal reply coupons. However, he was merely using funds from new investors to pay off earlier investors, with little or no legitimate investment activity taking place.

Ponzi’s scheme eventually unraveled, resulting in his arrest and subsequent imprisonment. The legacy of the Ponzi scheme lives on, with similar fraudulent investment schemes often being referred to as “Ponzi schemes.” This historic scam serves as a cautionary tale about the dangers of unrealistic promises, unsustainable investment models, and the need for investor skepticism and due diligence.

The Takeaway

The biggest financial scams in recorded history have left a trail of destruction, shattered dreams, and profound lessons. From the elaborate Ponzi schemes of Bernie Madoff and Charles Ponzi to the corporate frauds of Enron and Lehman Brothers, these scams exposed the vulnerabilities, flaws, and moral pitfalls within the financial system.