As with most blockchain startups, the story begins with a real-world problem. This problem centers on the global real estate industry, whereby access to reliable, secure, and readily available data can be a somewhat daunting task. In terms of availability, data is often monopolized by a handful of industry leaders, making it difficult for external stakeholders to get a look in.

Moreover, with no incentives in place to share such data, organizations are motivated to control the information they possess. Real estate data that is available within the public domain is often dispersed across multiple independent channels, with no mechanisms in place to verify the accuracy of the provided material.

So where does this leave us in a data industry that is worth close to $25 billion? According to the team at Rebloc – the solution lies in robust data integrity and coverage, alongside privacy validation and incentivization – all of which can be achieved by democratizing real estate data onto the blockchain.

Contents

Who is Rebloc?

At an organizational level, the Rebloc project is a dual venture between two industry leaders from the real estate data and technology sectors. By combining forces, the project has installed talent with a proven track record. Responsible for driving the Rebloc project forward, Gary Yeoman has enjoyed a plethora of success in multiple real estate ventures. This includes Altus Group, where he served as CEO. The project also benefits from a strong board of advisors – including Elie Galam, Chief Investment Officer at Eastmore Group.

The venture is further bolstered by iLOOKABOUT veteran Jeff Young. ILA specializes in visual and data analytics, with a direct focus on supplying technological solutions for the real estate and property assessment markets.

Tokenization

Although the project is looking to build their network on top of the blockchain protocol and as such, tokenize their in-house economy, the team have opted against going down the initial coin offering (ICO) route. This is the process of raising capital in the form of major cryptocurrencies and subsequently providing investors with a proprietary utility token.

On the contrary, the model centers on contribution. In other words, if you become part of the Rebloc democracy by collaborating in the sharing of accurate and readily available data, then you have the chance to monetize in the form of the Rebloc token.

The network will be built on top of the Enigma protocol, meaning that stakeholders can purchase, sell or exchange data through the utilization of smart contract technology. Moreover, this can be achieved in a safe and secure eco-system, whilst fully protecting the privacy of those involved.

How will Rebloc achieve its goals?

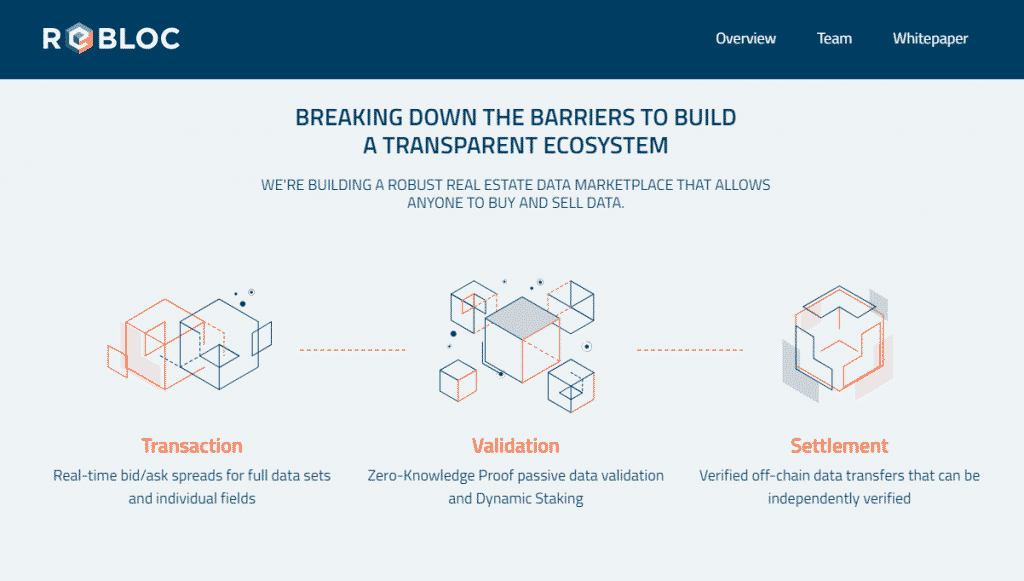

As per the information outlined in the Rebloc whitepaper, there are a number of angels that the team is looking to cover. First and foremost -to enable the ReBlock network to operate in an autonomous manner, when the end-user attempts to buy real estate data, the smart contract will extract this information from the relevant provider.

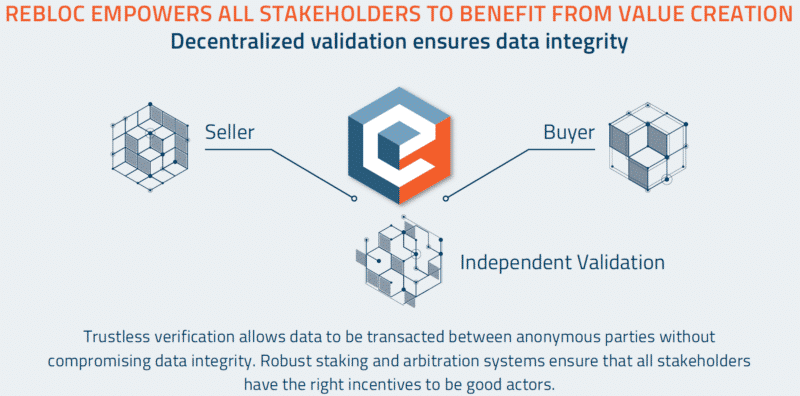

However, prior to the data transitioning over to the consumer, it must first go through a validation process whereby the smart contract will aim to reach a consensus on the accuracy of the information. If this can be achieved, the consumer receives the data and the provider is subsequently remunerated for their contribution.

On the other hand, if the blockchain cannot reach a consensus on the reliability of the data, the consumer is not charged. If this is the case, the data provider in question receives a proportionate penalty.

The reason for this is that it not only motivates stakeholders to ensure that the data they contribute is accurate – but it also ensures that the ReBlock network preserves its integrity.

A second angle that the ReBlock team is looking to revolutionize is the availability of data in real-time. The project aims to achieve this by utilizing an indexing strategy that is fully supported by the underlying technology of the blockchain protocol.

Essentially, indexing maintains a stringent database of information that can be shared without needing the validator to independently involve themselves in the transaction. By removing the centralized role of the provider, data can be extracted in a seamless manner without comprising security.

Ultimately, for the project to achieve success in both the short and long term, it requires a collaborative approach between all parties involved. What this means is that for the real estate data sector to flourish in a collective manner, the contribution of accurate, seamless, and relevant data must be rewarded in a fair and transparent eco-system – which is something that ReBlock claim to be able to facilitate in the form of utility tokenization.