In the world of cryptocurrencies, influencers have emerged as powerful voices, guiding and shaping the opinions of many enthusiasts. While some influencers genuinely provide valuable insights, it’s essential to approach them with caution. In this article, we’ll delve into the intriguing realm of crypto influencers and uncover a few reasons to not blindly trust Crypto influencers.

Contents

1. Hidden Agendas and Conflicts of Interest

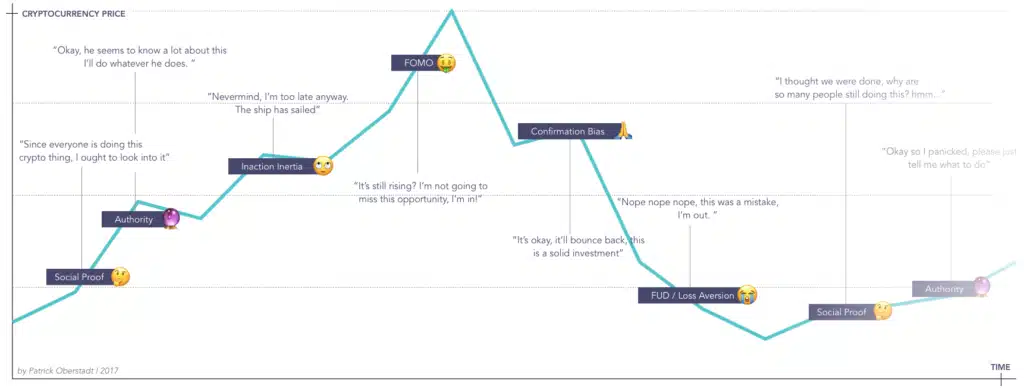

It’s important to recognize that influencers, despite their portrayal of being unbiased, can have their own motivations and interests that may not align with their followers’ best interests. While they may appear trustworthy, it’s crucial to be aware of potential hidden agendas and conflicts of interest that could impact their recommendations.

One common concern is the pursuit of personal gain. In the realm of cryptocurrencies, some influencers may have significant investments in specific digital assets or projects. Their promotion of these cryptocurrencies could be driven by their desire to increase their own financial gains. As a result, their recommendations may not be based on genuine analysis or a belief in the project’s merits but rather on their personal financial interests.

2. Lack of Expertise and Misinformation

Indeed, not all influencers dedicate the necessary time and effort to stay well-informed about the topics they discuss. This can result in a lack of technical understanding or depth of knowledge, which may lead to inaccurate insights or guidance being shared.

This lack of expertise can contribute to the dissemination of misinformation. Influencers who do not possess a comprehensive understanding of cryptocurrencies may unintentionally provide incorrect information, make inaccurate predictions, or misinterpret market trends. Followers who rely on this information may make ill-informed decisions, potentially resulting in financial losses.

Additionally, the crypto space is known for its speculative nature and the prevalence of rumors and unfounded claims. Some influencers may unknowingly perpetuate these rumors without verifying their accuracy, leading to the spread of misinformation within the community. This can create confusion and hinder the decision-making process of followers. So, don’t blindly trust Crypto influencers

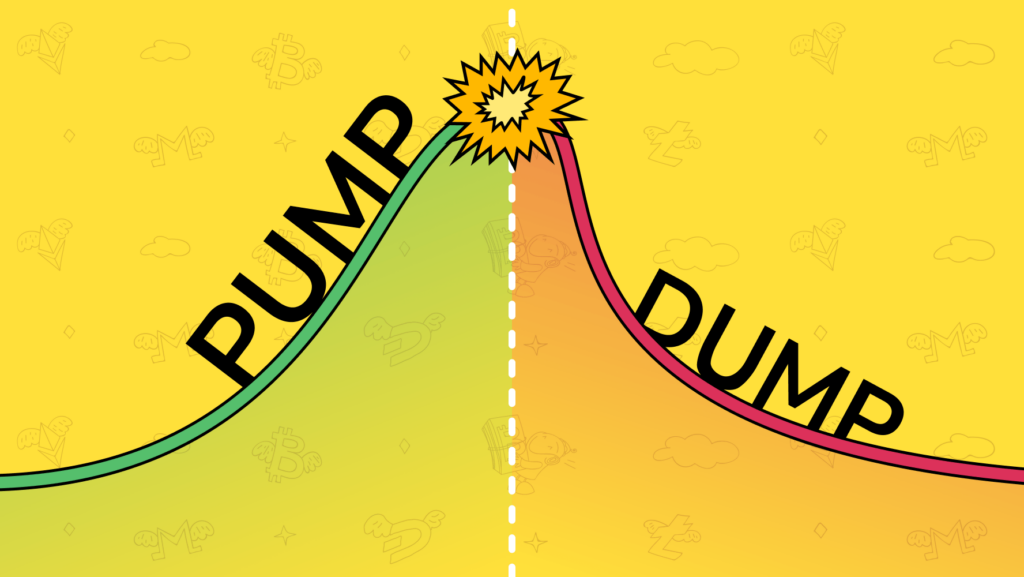

3. Pump-and-dump schemes

Pump-and-dump schemes are deceptive practices frequently observed in the cryptocurrency market. Their goal is to artificially inflate the price of a particular asset before selling it for a profit. Such schemes involve coordinated efforts by a group of individuals or influencers working together to manipulate the market.

The process typically starts with the orchestrators accumulating a significant amount of a specific cryptocurrency, often choosing one with low liquidity and market capitalization. They then create a sense of hype and excitement surrounding the asset by spreading positive news, rumors, and exaggerated claims about its potential value and future prospects.

It is important to note that pump-and-dump schemes are considered highly unethical and illegal in most jurisdictions. They exploit unsuspecting investors and manipulate the market for personal gain. Regulatory bodies and law enforcement agencies actively strive to identify and prosecute individuals involved in such schemes to protect investors and uphold market integrity.

4. Biased Research and Analysis

Biased research and analysis occur when data, information, or findings are manipulated or distorted to serve a specific agenda or viewpoint. In the context of crypto influencers, this can involve selectively presenting information that supports their preconceived narrative while downplaying or ignoring potential risks.

One common tactic is cherry-picking data, where influencers focus on the positive aspects of a cryptocurrency while neglecting its potential drawbacks or risks. This skewed presentation can lead to incomplete and misleading information, influencing investors to make decisions based on an inaccurate understanding of the situation.

To mitigate the impact of biased research and analysis, it is important to look for influencers who prioritize transparency and disclose any conflicts of interest they may have. Seek out individuals who emphasize the significance of thorough research, effective risk management, and long-term investment strategies instead of promoting quick profit schemes.